Eunice is in a Chama registered as the Rich Today Group. They are a total of 10 members in this group and they each contribute Kes 10,000 on a monthly basis. They therefore pool together and collect Kes 100,000 per month for investments. They have decided to be putting these funds in the stock market. Their rationale is that they want to Grow the value of their money over time and they believe that the stock market offers this opportunity. Before Eunice joined this Chama she had considered investing in the stock market by herself. However, currently her job at the pharmacy means that she keeps long working hours and therefore she would not be able to do the necessary research and keep track of the movements on the stock market. Also she figured that Kes 100,000 per month can be invested in more companies than just Kes 10,000. Another reason that she joined Rich Today, is that there was someone within the group who had good analytical skills, had some experience with the stock market and was going to assist them with the day to day decision making. However there had been another prospective member called Sally who declined the offer to join Rich Today. Though she was keen on investing in the stock market, she felt that she wanted to be hands on, do the research, learn and most importantly wanted to have her own way regarding which shares she invests in or not.

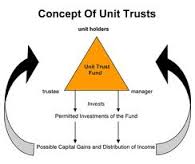

We have often heard the term “Unit Trusts” being floated around and many times we do not actually know what it means other than it is some sort of investment. You may have seen the page in the newspaper with the column title “Unit Trusts” but backed off when you saw very many percentages and numbers, very many names all ending with the word “Fund”. The Unit Trust is the sophisticated version of the Rich Today Group. The concept is exactly the same. Unit Trusts are vehicles that pool together financial resources of different people to pursue a common investment. Just like Eunice, the rationale of someone choosing to pursue a particular investment through a Unit Trust is that they think they will benefit more if they combine their resources with other people and/or they feel they don’t not have the time or know how to do it themselves.. Eunice knew when she joined Rich Today Group, that she would not be in charge of the decision making. The same applies in a Unit Trust where by the very structure of Unit Trusts, professional fund or investment managers are appointed (and paid management fees) to make the everyday decisions to ensure that the investment objectives are achieved. Investors do not have to have the same level of funds in a unit trust. Someone may have Kes 10,0000, another Kes 100,000 another Kes 1 million but all are invested in the same fund. To differentiate this, ownership units (similar to shares) commensurate with the funds invested will be issued to the investors. So the person who invested Kes 10,000 will be issued with less units than the person who invested Kes 1 million.

So are all Unit Trusts the same? How the operate, yes but not where they invest. The many names you see on that column in the paper are an indicator to where these funds are being invested. The Rich Today Group is essentially operating like an Equity Fund. Here funds are pooled together and managed for the purposes of investing primarily in the stock market. If you choose to invest in this fund you have accepted the same risks and returns that come with the very nature of investing in the stock market. Many times I have heard people blame the investment manager that the value of their investment fell. It is usually not the fund managers’ fault but the general environment in which stocks are trading. Most probably if you invested directly in the same basket of shares that the manager did, your portfolio would have performed in the exact same manner. It is important therefore to note, that the Unit Trust is not an investment by itself but the vehicle in which you have chosen to access the stock market, in the same way Eunice chose this Chama knowing the agenda was investment in stocks. The Unit Trusts would not be ideal for Sally, as she wants to make the everyday decision on what to shares invest in. She should therefore go to a stock broker directly. Other popular Unit Trusts are the Fixed Income Funds; which invest primarily in Treasury and Corporate Bonds (Bonds were covered in our article last week). We also have the Money Market Funds; which place money in short term safe vehicles like deposit accounts with banks and Treasury Bills that earn interest. The same benefit of pooling here applies. If I go to the bank with Kes 100,000 to put in a deposit account I will get minimal interest because the amount is small but when the investment manager goes with Kes 10 million, the rates he gets are much more favourable. Through the Unit Trust my Kes 100,00 will still earn the same interest as someone who invested Kes 1 mn. Balanced Funds would provide access to a combination of various investments.

So your objective for the investment would really drive which Unit Trust you want to invest in or whether unit trusts are really the investment for you.

Waceke Nduati

The author runs a program on personal financial management. Find her at waceke@centonomy.com or on twitter @centonomy.

Question and Answer

You mentioned one has to open a CDS account with central bank to invest in bonds. Now is this the same as the CDS account used when buying shares at the NSE? Do you have to go directly or can you use a financial advisor? Secondly what does one require to open this CDS account? Thanks in advance.

You can open this CDS account directly with the Central bank or you can by the bonds via client accounts through their authorized agents including banks, stockbrokers. There is no fee for opening the account directly with the Central bank but the authorized agents may charge you a handling fee. This CDS account is different from the one you would open to trade in securities on the NSE. To open this CDS account you need to fill in an application form (available on the Central Bank website), provide photographs and identification documents.

Your article on bonds was really eye opening and I can see it really is not rocket science. What is the difference between Treasury Bills and Treasury Bonds?

The principle is the same i.e. the government uses these two vehicles to borrow money to fund expenditure. The key difference is the time period. Treasury Bills however are for a short period of time i.e. three months, six months and twelve months as compared to Treasury Bonds which range from 1 year to 30 years. Interest is calculated in a different way with treasury bills and I will cover this in a subsequent article.

Waceke Nduati

Email your questions or comments to Waceke at waceke@centonomy.com| twitter @centonomy

The explanation on unit trust has made me understand it more I had invested in one last year but could not understand why I lost value over time. thanks you are truly remarkable.

Hi Fred,

Happy New Year! I’m truly glad to know that you were among those who gained fronm that article. Based on the response that we get when we tell people about unit trusts in the course, you are not alone since most people have not fully understood how they work. This is why we explain all about this and other investment avenues in Kenyta to all Centonomy 101 students. We’d love to see you join us in our February intake. We also welcome you to come for our open day which will be on the 18th of January at Tha National Museum Of Kenya in the Louis Leakey Auditorium. Entry is free and feel free to bring along everyone you would like. We’ll be there from 10am-1pm. See you there. Have a blessed day.

Hi, I watched your interview on young rich and I started reading the blog yesterday. Thank you for the wisdom/knowledge/advice. It is absolutely priceless. I also wanted to ask whether there will be any other open days soon. I would really like to attend one or two…