Fred has a good job he enjoys with a local marketing company. This week, he was called in by his boss and advised that the company had lost one of its major clients (due to no fault of Fred). Because of loss of this account, the company’s revenues would take a beating and unfortunately they have to lay off staff. Fred is unfortunately one of the people who have been laid off. This news came as a complete surprise to Fred. He had just bought a new car financed with a loan and he has a young family. To many of us this may be something we are going through, have gone through or can go through.It does not necessarily have to be a job loss. It could be an illness that means we cannot work for a while. It may be, just like the company Fred worked for, your business is unable for any manner of circumstances, to generate revenues for a while.

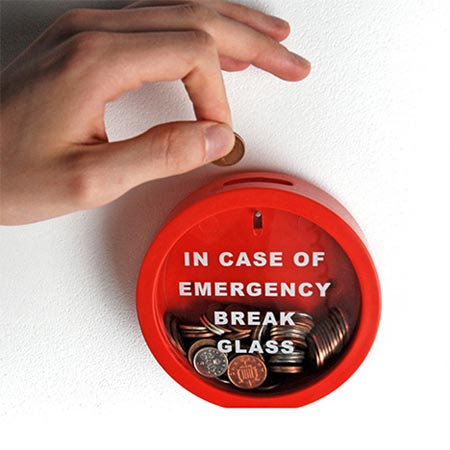

Look at your current investments and ask yourself how long you would survive on your lifestyle. Doing this makes you realise how dependant you are on the next paycheck. If the day before you are paid, something happens and payments are delayed for a week, what would you do? Planning for emergencies or setting up an emergency fund is something that should be the first step in developing a financial plan. What is an emergency fund? It is not money to handle your friends or relatives emergencies. It is money that is set aside to handle situations like the one Fred is in. Funds that have been kept aside to ensure that you have some time to recover should you ever lose your current income. It is suggested that you work towards having 3 to 12 months of this cover.

For example if your current lifestyle costs you Kes 50,000 per month, and you wanted to have a three month emergency fund you would need Kes 150,000 in total. If you decide to work towards establishing this over the course of two years, you would need to save Kes 9,000 per month. Having this set aside ensures you can survive for three months and figure out what your next steps are such as looking for another job. This emergency should also include your monthly debt repayments. If you lose your job today, the bank will still expect you to service your loan obligations. Remember the higher your lifestyle is the more you need to establish the Emergency Fund.

How do you turn this plan into reality? Do not wait for the Kes 9,000 to be in the bank account at the end of every month. Once you get paid, the money should be transferred into something like a savings account before you start dealing with your other expenses. You should also keep this money somewhere that can be easily converted into cash. A plot of land cannot be your emergency fund because it may take a while to sell the land and get money or you may not be able to sell it at all. Having this fund gives you the much needed time to think and plan for the next phase of your life whilst ensuring that you have money to live on for the short term.

www.centonomy.com | Twitter @centonomy.