There is a lot of financial information out there being thrown at us. We may become daunted with information on interest rates, investments, managing expenses etc.

However rarely do we get information on how to put all these finance related aspects in a way that is applicable to ones individual circumstances. Because of lack of understanding, we at times tend to get carried away with the financial flavour of the month which could be a particular stock, insurance product, credit card, mortgage loan, chama etc Financial salesmen are doing their utmost best to earn a commission from our hard earned money, but not enquiring on what we actually want to achieve. We have in our personal lives various goals but the one that is usually least articulated is the financial one.

When trying to define your Financial Goals, asking yourself two simple questions. Firstly what you are going to use this money for or what do you want money to be able to do for you? Secondly when are you going to use this money? Money always has a “consumption point”. Whether you currently happen to spend everything you earn, or whether you are saving tons of cash, the truth of the matter is that ultimately the money will be used up. Your objectives will also help you identify whether you want your money to be used up more for the benefit of others such as supermarkets, restaurants, government (in form of taxes), banks (interest) or you want the money to be used up more for yourself e.g. various investments or projects, retirement portfolio etc. Once that is done it becomes easier to know which investment avenues are needed to fulfill this objective and consequently which spending patterns need to be adopted. No-one can define these objectives. What’s important to one person may not be as important to another. One mans meat is another mans poison.

The common factor to any objective is that it is something a conscious effort is being made to achieve. An objective is not practical if you are not working on it. Short term objectives may include being able to meet basic expenses such as food, rent, clothes, transport costs, entertainment etc. For a person who only has short term objectives like this most probably then their spending patterns will emulate exactly those objectives. This means the less you earn the less you spend on these short term needs and the more you earn the more you spend. Medium term and longer term financial objectives may include saving for a holiday, buying a car, buying a house, investing in a business, saving for education, retirement funding etc. For these people you will most probably find that current spending patterns are controlled because of the need to put money aside regularly for a specific purpose in the future. These people will not be spending all income and the more they earn does not necessarily result in spending more now but instead sacrificing/controlling current consumption for the sake of being able to actualize the bigger picture.

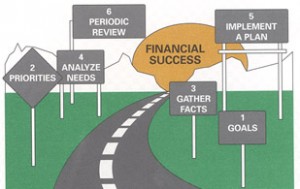

So where does it all start once the objectives are more or less defined? Careful evaluation of income versus spending is required. If the financial plan involves money being put aside for a medium or longer term objective the exact nature of that goal, its cost, the time period is then what will determine where the money goes to while in waiting for the ultimate “consumption” point. This is when research on various investment options such as, stocks, offshore investments, real estate will start to make sense. The exact allocation into any one of these avenues will also be driven by the goal. Some options will ensure your money is protected, others will ensure it generates income whilst others will ensure the actual value of the money grows.

The moral of the story is that there needs to be set objectives for your money first and foremost before developing any kind of reasonable spending, saving and investment pattern. Not having goals is akin to driving in the dark. Any challenge faced thereafter is due the sacrifice needed now to make that objective a reality. It requires time to research, learn about money management and investments. It requires maintaining a personal budget and creating a financial plan which is in essence working backwards to determine what amount of money needs to be put aside now or on a regular basis to achieve target.

Waceke Nduati-Omanga

waceke@centsiblewoman.com