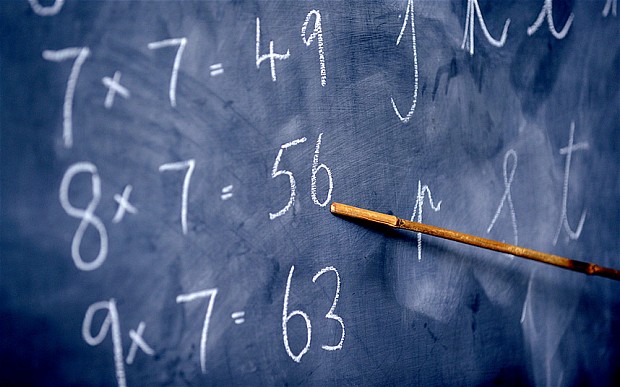

When I have conversations with people about money they always lament about not knowing about money earlier.In fact when people complete the Centonomy course many of them start wishing they had opportunity to apply the principles when they were younger. I have also been a late starter in applying some of the basic financial principles and for sure I have had my moment of wishing I had understood how certain things worked when I was in my early twenties. I definitely do believe that the subject of money should be taught in school and as early as possible. However we cannot get stuck wishing that we knew things but just move forward with what we know and get determined to learn what we may not know. The easiest way to create wealth is by understanding that you are indeed a student and commit to learn. We may not have been specifically taught about money in school. There was no subject called money. However I have come to realise that we probably had learned principles of money by the time we were in Standard three. The teacher may not have directly told us this is how you manage money but by learning numbers and how numbers work, we actually had the tools to start understanding finances. Whether you are investing or spending, you are in fact using these tools. You are using the same thing you learned in early primary school either to your financial advantage or disadvantage. Many people have written to me wondering how to start understanding money, how to plan, where to start investing, how to manage their spending etc. Just like what we learned in Math class, money works on the foundations of Addition, Subtraction, Division and Multiplication. The most important decision you have to make is whether you want to make less money (hence using subtraction and division), or you want to make more money (hence use addition and multiplication). It doesn’t matter if you did not like Math or the teacher. If you are dealing in any way with money you have got to come to terms with this basic arithmetic.

Many people are easily using Subtraction and Division. If I have Shs 10, 000 and decide to spend two thousand shillings on entertainment I will be left with eight thousand shillings. I have subtracted two form ten. If I continue subtracting I will eventually have zero. If I have the same amount of money and decide to give half away, I have divided my money. Subtraction and division make your money less. Definitely we have expenses and other obligations and to some extent we can never avoid the subtracting. So to ensure we do not end up with nothing we must add and multiply. Say I can save Shs 10, 000 a month from my income. That adds up to Shs 120, 000 in the first year. By the end of the second year it will be Shs 240, 000 and by the end of the fifth year I will have Shs 600, 000. That is what my monthly saving of Shs 10, 000 has added up to. The ability to create wealth, and not just save, lies in multiplication. We were not made to cram those multiplication tables for nothing. We were being told that yes, indeed 10, 000 every month for a year adds up to 120, 000. But also 10, 0000 multiplied by 12 is the same amount of money. You can wait one year to get that amount or you can start thinking of ways to actually multiply that money faster to achieve the equivalent or greater benefit. In school we were actually taught that multiplication could be a short cut to addition. I can take a long time adding ten over and over. But if I can remember 10 X 12 = 120, I do my sums faster.You can also create wealth or make money work for you faster by multiplying. You invest to multiply what you have. If I invested my Shs 10, 000 and got a 10% p.a. return, I will have Shs 732, 000 in 5 years and not just 600, 000. By the simple choice of putting money where it can multiply I get Shs 132, 000 more. I can get a return close to that right now in something as simple as Treasury Bills. If I got more aggressive and maybe looked at property in areas that may grow in the next 5 years, business ventures, investments in companies or shares I could get to over Shs 800, 000 or more (assuming a 15% p.a. return). The best investment for you to start thinking about is the one you can use to start multiplying your money; it is not the one you will be able to afford in the future. Investment is not also only what we traditionally hear about. If you can buy tomatoes and resell them, you have a good chance of multiplying that Shs 10, 000. The faster you can multiply your money the better. While I was on radio today someone asked me if it is too late to start investing at 40. It is never too late but we have to be practical. Numbers don’t lie so the older you are the harder you have to work at multiplying your money. The more urgent it is as you work towards educating children, retirement etc. As we multiply we have to make sure we don’t let the subtraction come back and eat into the gains. If you make your Shs 800, 000 and then spend half of it, you have simply taken yourself backward. When you make money keep multiplying it as much as possible. Yes there is a lot to learn but if you know how to add, subtract, divide and multiply then you actually have all it takes to learn the rest. It is not about how much you earn but what you can do with what you have. If you have children who know the same thing, the perfect time to start teaching them about money is now.

Waceke runs a program on personal financial management. Find her at waceke@centonomy.com|

Twitter @centonomy

Facebook Centonomy

That is a powerful piece. Thanks. I have now known that the money I get part-time should be made to multiply very fast. The older I am, the harder I should work.