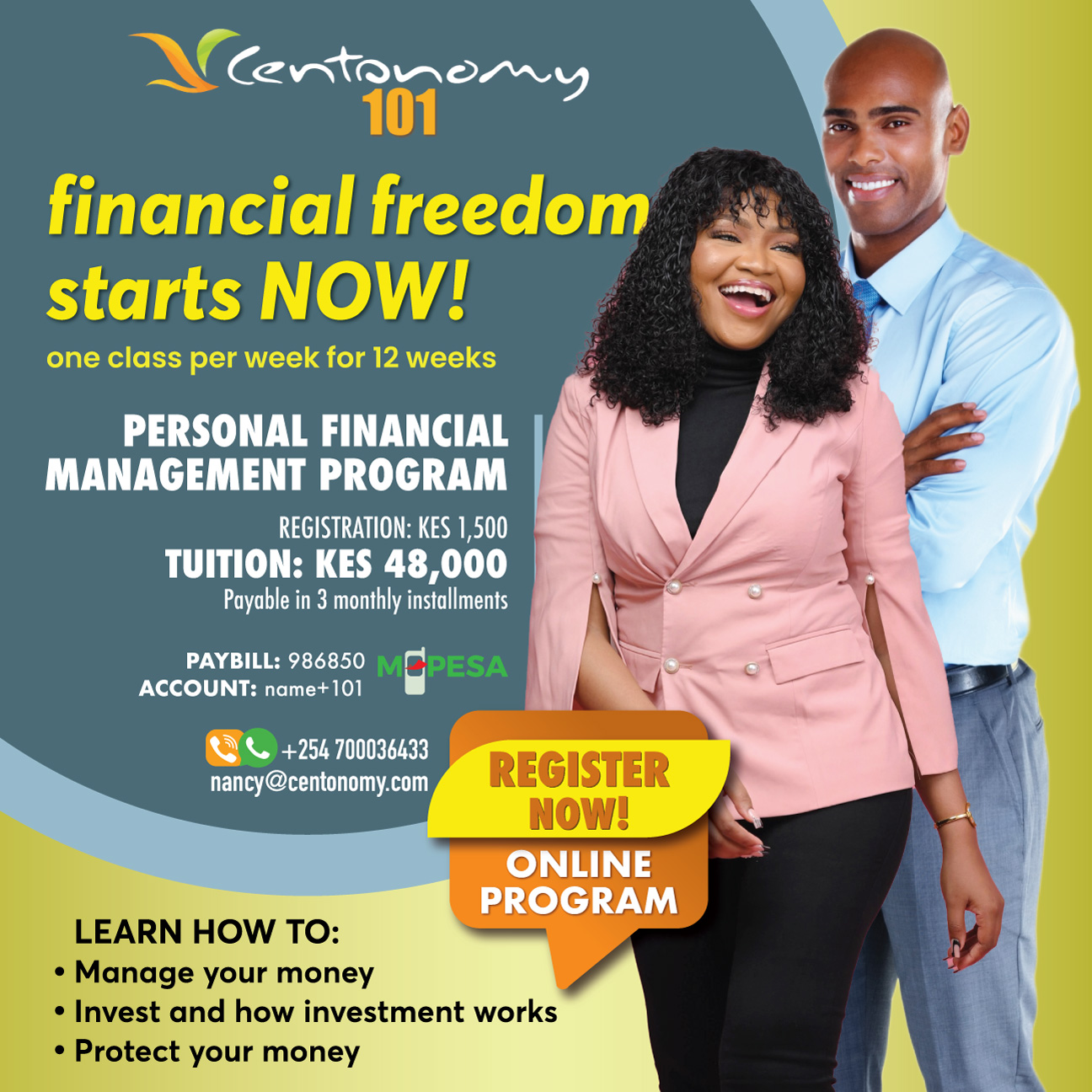

This Personal Financial Management Online Course will show you a direct, concise and easy to follow the path towards wealth creation. We will illustrate specific easy to follow choices that will accelerate your journey to Financial Freedom. The course is extremely practical and you will get an opportunity to work through actual situations/calculations related to your own personal circumstances with the aim of developing a financial plan and investment strategy that ensures you meet your Financial Objectives.

The curriculum has been built from actual real-life scenarios and these case studies will form part of the learning. Professionals from various fields such as lawyers, property experts, stockbrokers, fund managers, insurance experts will also form part of the facilitation team during the course.

The Online Course has 12 modules to be covered in 12 weeks. Students will be required to attend one class every week for two and a half hours. The modules will have personal assignments to be done to ensure that the concepts learned are put to practical application and that progress is continuously being made in developing a personal financial plan.

Enrollment is open for the June 2024 Intake. Classes will commence on 6th June 2024. Class options are either online via zoom.

Class options are as follows:

- Thursday: 6:00 pm to 8:30 pm

- Saturday: 9:00 am to 11:30 am

Certification:

Upon completion of the program, you get to graduate with the Centonomy Personal Finance Certificate which is NITA (National Industrial Training Authority) Certified.

Contact Us:

Tel: +254700036433

Email: nancy@centonomy.com

The Centonomy 101 Program is divided into 12 modules as follows:

1. PERSONAL MONEY MANAGEMENT

- Understand what Wealth Creation is

- Build a Budget/Spending Plan

- Build a Personal Balance Sheet & know your worth

- Build a Spending Tracker and understand where your money goes

2. TIME VALUE OF MONEY

- Understand the principles of Time Value of Money

- Understand the impact of inflation on our needs and wants

- Retirement Planning and Education Planning

- Set your financial goals, understand what they cost and start working on them

3. MANAGING DEBT

- Different types of debt and how they work (Mortgages, credit cards, bank loans, Sacco Loans etc.)

- Debt Amortization-Understand how your debt payments are calculated and how you can make this work in your favor

- Learn how to Pay Debt Quickly and Save on Interest Costs

- Learn how to get out of debt by creating a Personal Debt Repayment Plan

4. LIVING ABUNDANTLY

- Develop the Mindset of a Wealth Creator

- Use your skills to create income

- Know what you truly want-GOALS

5. INVESTING IN TREASURY BONDS/BILLS & UNIT TRUSTS

- Understand what affects interest rates (Economic Indicators)

- Learn how to invest in Treasury Bonds & Treasury Bills

- Learn how to invest in Unit Trusts

6. INVESTING IN PROPERTY

- Understand the different property sectors

- Understand property development costs

- Learn how to select property investments

- Understand the property acquisition process

- Understand Unit Trusts & Real Estate Investment Trusts (REITS)

7. INVESTING IN THE STOCK MARKET

- Understand the Stock Market

- Learn how to trade in the stock market

- Learn how to evaluate investments in private companies/businesses

8. INSURANCE

- Insurance as an investment option

- Understand how the different Insurance Policies work

- Learn how Education Policies work

- Why Life Insurance

9. ESTATE PLANNING

- Learn the different types Wills, how to draw them up and their importance

- Understanding Trusts, how to create them and their importance

- Understanding Family Companies, how they are created and how they work

- Succession Planning

10. TAXES

- Understanding your personal taxes

- How do taxes fit into your financial plan?

11. MY FINANCIAL PLAN

- Create a Personal Financial Plan-roadmap to your Goals

- Set targets and action plans to achieve your goals

- Create an Emergency Fund & plan for irregular expenses

12. INVESTMENT GROUPS, IMPLEMENTATION & GRADUATION

- Forming, Managing & Creating an Investment Group

- How your Investment Group can be your retirement vehicle

- Working with a Financial or Investment Advisor

With the Centonomy 101 course you will learn how to:

- Manage your monthly Income and Expenses.

- Tackle Debt Effectively.

- Understand how to make Money Work for You.

- Afford quality Education for your children

- Know where to Invest and Increase your Investment Returns

- Retire and still be able to maintain your desired lifestyle

- Find Financial Peace of Mind and Live Abundantly

Contact Us:

Tel: +254700036433

Email: nancy@centonomy.com

Enrollment is open for the June Intake. Classes commence on June 2024. Class options are online on our zoom platform.

Pricing

Registration and booking fee is Kes 1,500

The tuition fee for the 12-week course is Kes 49,500 (inclusive of 16% Vat) for the 12 modules.

Payments can be done in three monthly installments i.e.

- 1st Installment: Kes 17,000 Payment made on or before your first day of class

- 2nd Instalment: Kes 17,000 Payment made at the start of the 5 Module

- Final Instalment: Kes 14,000 Payment made at the start of the 9 Module

Payments can be made via

Mpesa to the PAYBILL number 986850 (the account number is your name)

Cheques made out to Centonomy Limited

Cash deposit to GT Bank, Skypark Branch. Account Number 2250002966

NO Cash Payments Please

For International Clients

The cost for the program is 400 US Dollars paid once before we start class i.e. on 6th June 2024.

Payment Details

Bank Name: Centonomy Limited

Bank: Guaranty Trust (Bank) Kenya Limited

Bank Account: 2250011094

Branch: Skypark

Bank Code: 53

Branch Code: 015

Swift Code: GTBIKENA

CONTACT INFORMATION

Location: Centonomy Ltd, Dale House, Rhapta Road, Westlands

Tel: +254700036433

Contact Person: Nancy Oketch

Email: nancy@centonomy.com

There are no reviews yet.