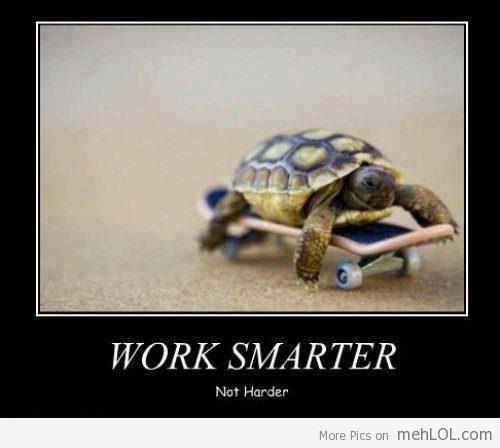

As I sit wondering what to write about for this week’s column there is a bee in my office at the window. It is buzzing away and getting more and more irritated as it tries to find an exit out back into the open. It continuously searches and tries the same spot over and over again revealing the limitation of its futile strategy. The try harder, try harder and when that fails try again. Just two feet away is an open door that would put the bee back into the free world. It just needs to direct its buzzing towards the big open door on the left as opposed to the small closed window. All it will take is an extra five seconds. The bee just needs to try something different. I am asking myself why this frustrated bee got so attached to the fact that the closed window is the only route to success. It got me thinking. Yes we do need to work hard but working harder at the same thing is not necessarily the route to go with our financial goals. Here are some examples from a few people I have worked with or met who simply did something different. They didn’t have more money or education. They just tried smarter not just harder.

Jane and Melissa are full time bankers. Last year they took advantage of the cheap loans offered by their employer and bought town houses in the Kasarani area for investment purposes i.e. renting them out. The houses were being rented out for about Shs 20,000 per month. Even on the subsidized interest rates they both had to contribute about Shs 30, 000 per month (in addition to the rent) to cover the repayment to the bank. For about six months this arrangement worked fine for both of them. But one day Melissa was having a conversation with a student who was attending a university nearby who mentioned the shortage of student housing. Melissa started doing her investigations and realised that students to that particular university were travelling from very far to attend classes. She could indeed with her townhouse provide a solution for these students. After the lease with her current tenants expired she borrowed a bit more money to do moderate renovations to the house. She got the necessary approvals and converted it into serviced student accommodation. She now has 6 female students livingthere paying Shs 15, 000 per month. Her monthly income moved from Shs 20, 000 to Shs 90, 000. She is able to comfortably service her mortgage on the property without her dipping into her personal income and still retain some money. Same asset as Jane but she is simply being smarter with it.

Simon and Peter got loans a year ago and each bought a mkokoteni. Each day they would earn Shs 1, 500 by transporting goods for various people. They work for 6 days a week hence earning up to Shs 9, 000 per month. Today Simon is still pulling the mkokoteni and earning between Shs 9, 000 and Shs 12, 000 per week. Simon has gotten into the habit of spending as he earns and though comfortable is still reliant on going to work everyday to earn a living. Peter after three months had bought another mkokoteni. Since he had to pay the transporter he was making Shs 1, 000 per day on this second one. This was an extra Shs 6,000 per week in his pocket. He now has four of them plus the original one that he pulls himself. He works the same hours every day as Simon doing the same thing. He still pulls a mkokoteni, the difference being that while he is working there are four other mkokoteni’s on the road earning him an income. As opposed to earning Shs 9, 000 a week like Simon he is earning Shs 33, 000. Same labour, same time, same ability only that Peter has chosen to work what he has in a smarter way.

Beatrice has been working as a secretary for five years in Thika. She needed extra money to afford the school she wanted her daughter to go to. Three years ago she started doing documentation/typing work for smaller offices that could not afford full time administrative staff. She would make an extra Shs 10, 000 a month doing this. After about six months her workload increased and she decided she needed help. The young lady that she tried to outsourcework to was hard working but her computer skills were not up to the standard her clients had come to expect from Beatrice. However she was sold by her attitude so then decided to train her at a small fee that she would deduct from her payment. She would work in Beatrice’s house, while she was at work. Shortly Beatrice got subsequent requests to train people on basic computer skills. She started doing this one client at a time and charging an hourly rate. As the requests for her training grew she decided to be smarter with her time. Why spend one hour on one client when in that same hour you can train 10 students on the same thing? Today she trains 15 people every weekend in her garage with each paying Shs 1, 000 per class. She earns Shs 60, 000 per month as opposed to the Shs 10, 000 she started with. She is still working but earns more than her salary with just three hours on Saturday. Same set of skills as many other people but she is being smarter with them.

These examples are just a drop in the ocean. Be the person who notices flies through big open door rather than buzzing in frenzy at the small closed window. Try doing it different and smart.

Waceke runs a program on personal financial management. Find her at waceke@centonomy.com|

Twitter @centonomy

Facebook Centonomy

nice one..

smart!